McKinsey Says 2035. I Say They're Off by 5 Years.

McKinsey just dropped a 10-page report predicting how AI, demographics, and trust will reshape US wealth management by 2035. It's a solid report — well-researched, carefully hedged, consultant-perfect. The data is real, the trends are undeniable, and the six themes they lay out are directionally correct.

But I read it differently than most people would, because I'm not a consultant. I'm a Head of Products — technology product, not financial products — at a financial firm who still codes every day, and I'm building AI-native systems on the side. The future they're describing? Parts of it are already here. The rest isn't 10 years away — it's 5.

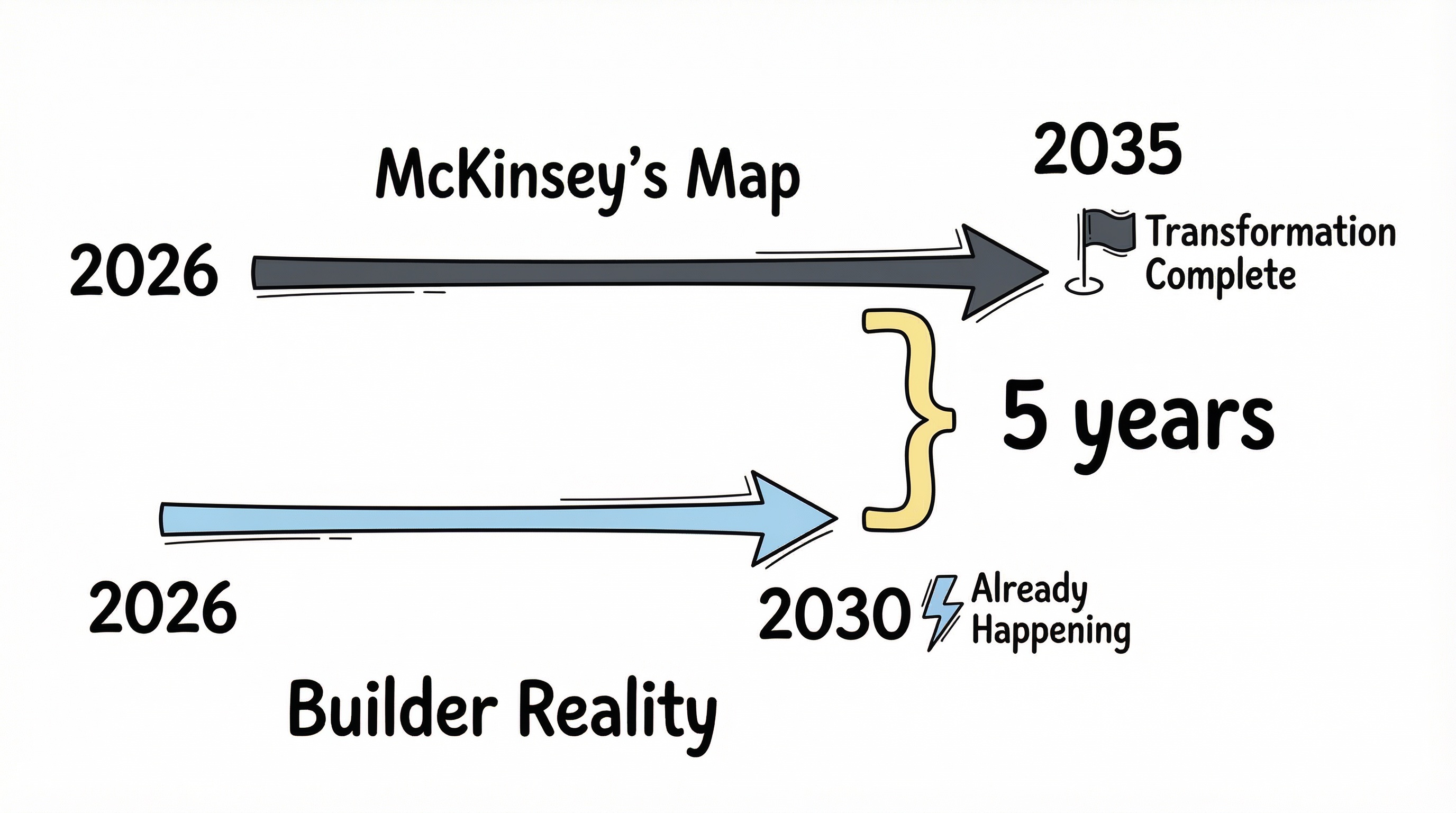

The gap between consultant timelines and builder reality is the real story. And firms that plan for 2035 will be disrupted by firms building for 2030.

The Report in 60 Seconds

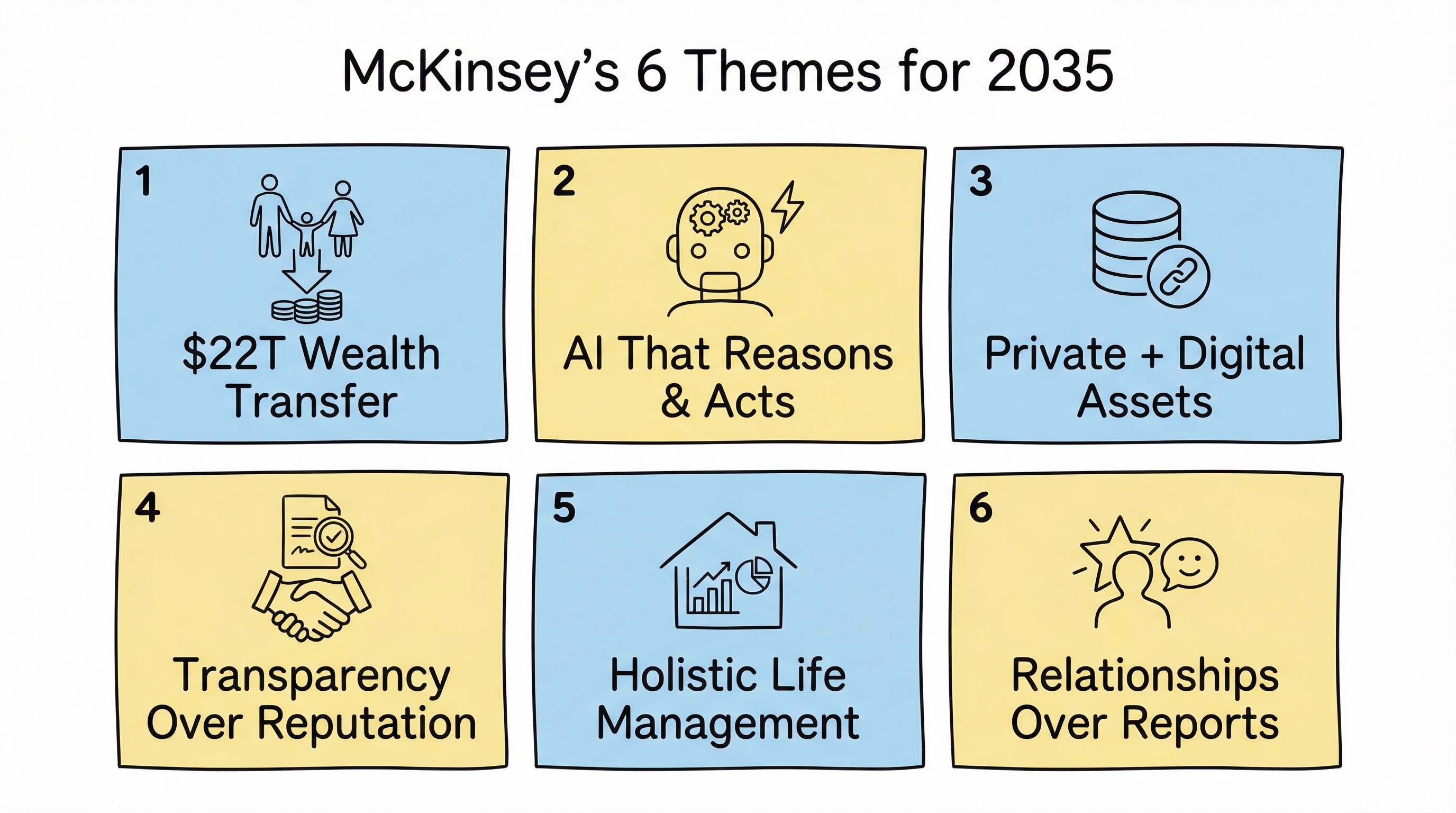

McKinsey identifies six themes that will define US wealth management by 2035:

- Demographic shift — a $22 trillion wealth transfer to Gen X and millennials, women controlling 40%+ of wealth, and a projected 100,000 advisor shortfall

- Agentic AI — a shift from task automation to AI systems that reason, plan, and act autonomously

- Asset class expansion — private markets, real assets, and digital/tokenized assets moving mainstream

- Trust rebuilt through transparency — institutional reputation giving way to demonstrated performance and radical openness

- Every client becomes a family office — holistic "life management" beyond investments into tax, estate, and lifestyle

- Advisors evolving from planners to life coaches — the human role shifting to relationships and guidance, not information delivery

They also identify four competitive archetypes that will dominate: mega-platforms that win on scale, boutiques that win on relationships, independent platforms that win on flexibility, and AI-native firms that win on efficiency.

The full report is worth reading — link here. But here's my take from someone inside the industry.

Where McKinsey Is Right

The advisor shortage is real and urgent. I don't need McKinsey data to confirm this — I see it in my own firm every day. Experienced advisors are retiring, junior hires take years to ramp, and the pipeline is not keeping pace with client demand. McKinsey's 100,000 advisor shortfall might actually be conservative. The math doesn't work without AI augmentation, and most firms know it.

Trust is already shifting with younger clients. McKinsey cites 76% of Gen Z seeking financial advice online, versus only 14% who would turn to a financial professional first (compared to 39% of boomers). This tracks exactly with what I see in our product data. Younger clients don't want to be told what to do by someone with credentials — they want to be shown, in real time, with transparency. The "show me, don't tell me" dynamic shows up in every client interaction now.

The "family office for everyone" trend is happening. McKinsey cites 52% of investors seeking holistic advice in 2023, up from 29% in 2018. Clients are already demanding that wealth managers help with more than just portfolios — they want tax strategy, estate planning, insurance, and even lifestyle decisions bundled together. The tech to deliver this at lower wealth tiers is arriving. We're actively building toward this in our product roadmap right now.

On these three points, McKinsey is not just right — they're understating the urgency.

Where McKinsey Is Too Conservative

Here's where I push back.

Agentic AI is not a 2035 story — it's 2026.

McKinsey frames agentic AI as an emerging future capability. Meanwhile, I set up an AI agent on a Mac mini last week. It runs 24/7, does deep research, manages my content pipeline, sends me briefings every morning, and runs scheduled tasks autonomously while I sleep. I talked to it through WhatsApp yesterday about a blog post I was planning.

This isn't a research lab prototype. It's a dusty Mac mini with $15/month in API costs running production workflows for my content business.

In my day job at the financial firm, we're already using AI to augment product workflows, research, and reporting. The 62% of advisors who "intend to use AI" in McKinsey's 2024 data — the movers in that group have already moved. They're not intending anymore. They're shipping.

What used to take a research team multiple days now takes my AI agent a few hours. That's not 2035. That's today.

The four archetypes underestimate AI-native disruption.

McKinsey's four competitive categories (mega-platforms, boutiques, independent platforms, AI-native firms) treat "AI-native" as a separate niche. I think that's the wrong frame.

McKinsey actually hints at the right answer with the concept of the "firm of one" — a single advisor supported by hundreds of AI agents, serving a client load that would have required a team of ten. But they don't follow this thread to its conclusion: when one person can do what ten did, the economics of every model break. Not just the AI-native category.

AI-native isn't a niche. It's a capability that will eat into every category from the inside out. The boutique that onboards AI-native tools becomes a different kind of boutique. The mega-platform that figures out agentic client service at scale looks nothing like its current form. Every archetype gets disrupted, not just the ones in the bottom-right quadrant.

Portfolio transformation is already shipping.

Tokenization of real assets? Direct indexing? Digital assets going institutional? McKinsey frames these as 2030-2035 concepts. But spot crypto ETFs and ETPs already exceeded $150 billion in AUM. Direct indexing platforms exist and are competing for clients today. "Unified managed household" systems are in early production at forward-leaning firms.

These aren't pilots. They're products. The question isn't when they'll arrive — it's when the laggards will catch up.

What McKinsey Is Missing

Beyond the timeline, there are a few things the report doesn't adequately address.

The builder vs. buyer divide.

The biggest competitive gap in wealth management over the next five years won't be between firm types. It'll be between firms that build AI and firms that buy it.

We've seen this pattern before. During the digital transformation wave, firms that outsourced their tech strategy to vendors consistently lost to firms that built internal capability. The vendor solutions were always one generation behind. The firms that owned their tech stacks could iterate in weeks; the vendor-dependent firms waited for release cycles.

AI is the same pattern, amplified. Firms that build AI systems internalize the feedback loops — they learn what clients actually respond to, they tune the models for their specific use cases, they own the data advantage. Firms that buy AI solutions get a generalized product built for the average case, not their clients.

This distinction doesn't appear in McKinsey's four archetypes. But it's the most important differentiator over the next five years.

The real talent crisis isn't just about advisors.

McKinsey identifies the advisor shortage as a core challenge. Correct. But there's a second talent crisis hiding underneath it: who builds the AI systems?

You need product leaders and engineers who understand both financial services and AI architecture. Not advisors learning to prompt ChatGPT. Not AI engineers who have never touched a financial product. The hybrid — someone who can design an agentic workflow for client onboarding and also understands fiduciary duty, compliance constraints, and the emotional dynamics of a client who just lost 20% in a market drawdown — that person is genuinely rare.

I'm in this intersection. I lead technology product and engineering teams at a financial firm by day — building the systems that run the business, not managing financial products. I build AI-native systems on the side. I can tell you from direct experience: this skillset is the actual bottleneck. Not advisors. Not capital. Not regulation. Talent that bridges finance and AI is the constraint.

Client experience will leapfrog, not evolve.

McKinsey describes a gradual evolution from "clicks to conversations" — a smooth improvement in client-facing interfaces as AI gets better. I think this mental model misses how phase changes actually work.

When a client can have a real conversation with an AI that knows their complete financial picture — every account, every goal, every life event on record — and get instant, personalized, data-grounded answers at 11pm on a Sunday, the bar for the human advisor conversation changes overnight. Not gradually. Overnight.

The advisors who thrive won't be the ones who incrementally improve their service model. They'll be the ones who completely redefine what the human value-add is when AI handles everything it can. That's not an evolution. That's a phase change.

What This Means for You

If you're a financial advisor: The 62% of advisors "intending" to use AI will split into two groups. The ones who started in 2024 or 2025 will be building a capability moat that compounds over time. The ones who start in 2027 will be playing catch-up against people who already have 2-3 years of AI-augmented practice. Start now. Don't wait for a firm-wide rollout.

If you're a product leader at a financial firm: Push for building, not buying. Every year you spend waiting for a vendor to deliver a solution is a year your competitor's internal team is learning faster than your vendor's product team. The AI wave moves at software speed, not vendor contract speed.

If you're a builder or engineer: Financial services AI is massively under-served. Most fintech focuses on consumer payments or lending. Wealth management — the actual allocation and management of trillions in assets — is still being run with advisor workflows that haven't fundamentally changed in 20 years. The opportunity is enormous, and the intersection of finance + AI + product is where the biggest openings are.

If you're a client: Ask your wealth manager how they're using AI. Not "are you exploring it" — that's a yes/no anyone can answer. Ask what they built in the last 12 months. Ask what their junior advisors can do that they couldn't do two years ago. "We're exploring it" is a red flag in 2026.

The Map Is Right. The Timeline Isn't.

McKinsey's report is a solid map. The six themes are real. The demographic pressures are real. The technology trajectory is real. As a research artifact, it's excellent.

But maps drawn by consultants tend to underestimate builder speed. The people inside firms who are actually shipping AI systems aren't waiting for 2035. They're not waiting for 2030. They're iterating right now, this week, and the pace is accelerating.

I'm in both worlds simultaneously — Head of Technology Products at a financial firm by day, AI-native builder by night. The future McKinsey describes isn't 10 years out. For the firms moving fastest, it's already happening. For the firms still planning, it's about 5 years away — not 10.

The question isn't whether wealth management will be transformed by AI. That question is settled. The question is whether your firm will be a leader in that transformation or a case study in why the laggards lost.

Plan for 2035, get disrupted by 2030. Build for 2030, lead through 2035.

This is part of my AI Native Journey series, where I share what AI transformation actually looks like from inside a financial firm. If you're building at the intersection of finance and AI, I'd love to connect.